INT. CONFERENCE ROOM – DAY

Several NFL personalities are sitting in chairs around a conference table. They are all smoking cigars.

KATIE NOLAN: So…yeah. Now you boys know what it’s like.

JOSH ROSEN: How many is that so far, four?

COLIN COWHERD: Five, I think.

JOSH ROSEN: I’m pretty sure this is the point where we’re supposed to consult a physician.

LAWRENCE TYNES: Oh, do you guys need a recommendation? A urologist is probably the best guy to call, but I’ve got a really good proctologist and he…

JOSH ROSEN: We’re just joking, Lawrence.

BILL O’BRIEN: P-p-p-pretty sure we don’t need to c-c-call a d-d-d-doctor when a stock get halted five t-t-times in one d-d-day.

HUE JACKSON: The halt’s almost over, let’s see what happens next.

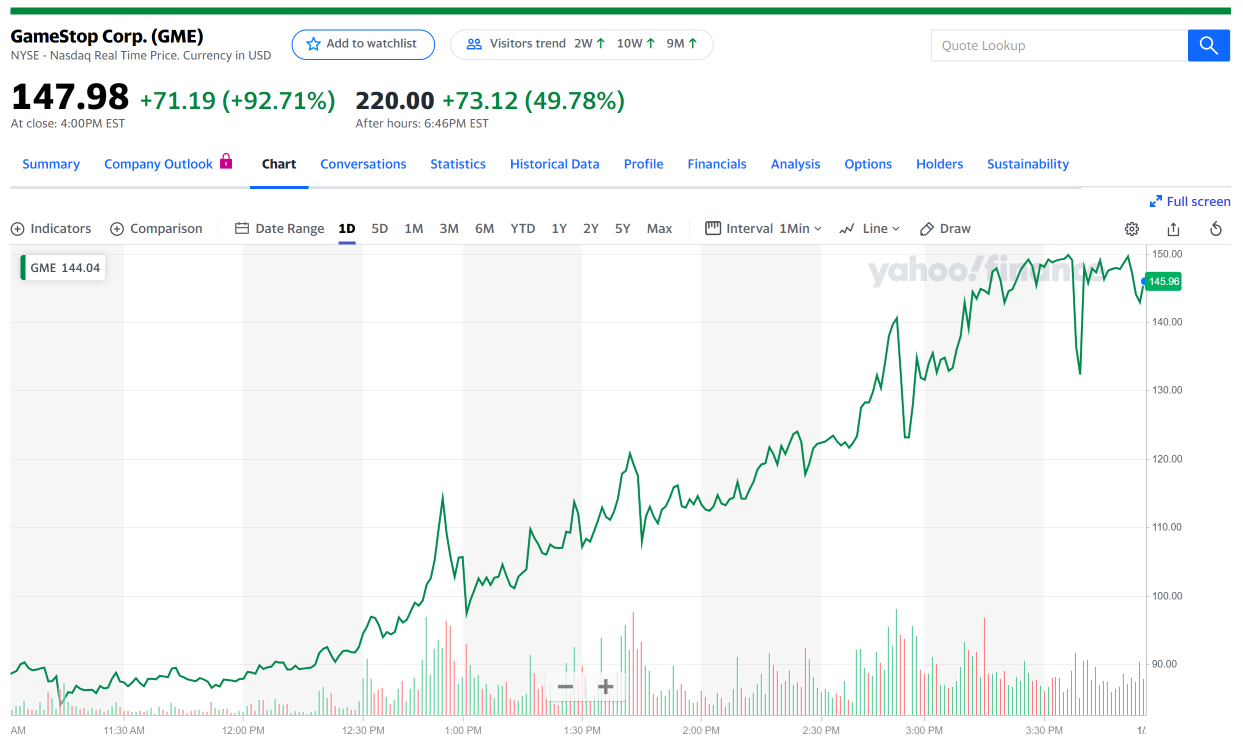

The gang resumes clustering around a single laptop, watching the $GME ticker.

COLIN COWHERD: [imitating Tom Cruise’s voice] It’s beautiful, man. Beautiful!

KATIE NOLAN: I just wish we’d had enough money to buy more than five shares.

COLIN COWHERD: I’m still not sure I understand what’s happening here, though. Josh, you’re good with this stuff, can you explain?

JOSH ROSEN: Goddamnit, Colin, if you don’t knock that bigoted shit off…

HUE JACKSON: [rubs hands together] Ooh, an NFL quarterback is losing his patience with a radio host…I’ve been waiting for this…

KATIE NOLAN: It’s not that complicated, Colin. A lot of people thought GameStop was on the path to being the next Blockbuster Video. Large physical footprint in a market sector that’s consistently moving towards an online space. So some people shorted the stock.

BILL O’BRIEN: And then more p-p-p-people shorted the stock.

KATIE NOLAN: To the tune of 140% of the available float.

COLIN COWHERD: Wait…

KATIE NOLAN: Let’s say there’s 100 shares of $GME on the market. People borrowed all 100, and then borrowed 40 more.

LAWRENCE TYNES: Like double-doinking I mean counting? Is that legal?

KATIE NOLAN: What, you think the SEC was going to do anything to stop them? But here’s the problem. When you short a stock, you’re borrowing the shares that you’ve sold. So until you pay those shares back, you’ve got to pay interest to whoever loaned you the shares.

COLIN COWHERD: Oh, you mean like the vig.

KATIE NOLAN: No, but…sure, whatever. At any rate, the more time that goes by without you replacing the shares, the more money you bleed due to interest. And when you short a stock, you’re expecting it to go down. Every day that doesn’t happen, you lose money on interest. And when it goes up, it means that it’s going to cost more money to buy back the stock so you can return the shares to your lender. So a lot of people bet that GameStop was going to go bankrupt. Not necessarily a bad idea. But in doing so, they left themselves incredibly exposed, because…what if the stock doesn’t go down? What if it goes up instead? So what a bunch of really stupid, really crazy people did was buy up as much GameStop stock as they could afford, and they pledged to hold it until the shorts decided to surrender and take a loss and buy it back at an inflated price.

COLIN COWHERD: What if the short-sellers can’t afford to buy it back?

KATIE NOLAN: Well that’s what you’re starting to see happen. In order to short a stock, you’ve got to have enough collateral to cover your bet. If the amount you owe goes up and up and up, eventually you run out of collateral and whoever loaned you the stock is going to close out the trade – with or without your consent – to make sure they don’t get stuck holding the bag. And when that happens, the price of the stock gets driven up even more, because there’s a lot of buying pressure on it. And that starts a cascade effect, because as the price keeps shooting up more and more, other people get margin calls, which drives it up even more in a vicious cycle. It’s called a short squeeze.

— [door flies open] —

DOUG MARTIN: DID SOMEBODY SAY SHORT SQUEEZE? [steps inside the room and gives KATIE NOLAN a big hug, then departs without another word]

COLIN COWHERD: So basically the short-sellers are getting taken to the cleaners?

KATIE NOLAN: That’s right!

COLIN COWHERD: So when do we exit our own position?

KATIE NOLAN: We don’t! We bought $GME because we saw Ryan Cohen buying in and decided that he was a good bet to turn the company around. This is a buy and hold for us. We won’t be selling for at least a year.

COLIN COWHERD: But what if it comes back down?

KATIE NOLAN: [shrugs] $TSLA didn’t. But this is going to be a fun week one way or another. Stay tuned.

I love genmaicha. It is healthy and smells lovely and is nice to have in the house on a winter day.

MOTHERFUCKER!

Pour one out for the great Cloris Leachman, folks.

https://www.youtube.com/watch?v=QpKXoFztGT0

Oh no. She’s a treasure.

She was 94, so it’s not necessarily a tragedy, but it’s definitely a bummer.

Blucher!

/a horse whinneys in the distance

Winnie

/revision/latest/scale-to-width-down/340?cb=20150919184851

/revision/latest/scale-to-width-down/340?cb=20150919184851

Also checkout the prequel to gamestop, Volkswagen, all the way back in far flung 2008.

https://priceonomics.com/porsche-the-hedge-fund-that-also-made-cars/

Even more hilarious than the current goings on, I’d say.

At the peak of the short squeeze, Volkswagen was technically the most valuable company in the world.

Just to be a total killjoy, I’m going to point out that while some hedge funds are losing money here, there are plenty of wall street firms making quite a lot of money out of this. Notably Citadel Securities, who are the market-makers for RobinHood. Why do you think options trades are free? Because firms make money off of allowing retail investors into the market.

But yeah, I just bought 48 shares of TAIL which I’ve been meaning to do anyway and called it a day.

Also, my Universal Yums box came yesterday and my next Bokksu box shipped today!

John Field, “comedian”

@AmericasComic

Oh, you’re laughing at the hedge fund that got juked by reddit? Well, they’re bankrupt now. Are you laughing now? Is it funny now that a bunch of MBAs are out of a job? Can you laugh knowing they’re explaining to their investors that they were out maneuvered by POTATO_IN_MY_ASS?

You also have to understand how crazy/stupid some of these guys are. Like the ones who thought they had figured out an infinite leverage glitch but it turns out what they were doing was technically “kiting checks”.

I just took a look and my 401K seems to holding relatively steady, so I’m going to continue to not give a shit about any of this, other than to root against the hedge fund short-sellers, because fuck them.

I just checked under my bed and my shoebox full of cash is holding steady also, with dollar amounts in the dozens.

Send me your address and I’ll have a Wallet Inspector come over and do a quick double check, just for additional security.

Sheffield United apparently woke up feeling pretty frisky.

By the way, Katie Nolan a loser investor?

She’s intended to be the voice of reason.

The last time I remember this happening was the hedge fund guy who bought a shitload of Herbalife stock and shorted it, and then spent years bad-mouthing the company, calling it a “cult” and a “pyramid scheme,” anything he could to try to drive down the price of the stock.

Is it illegal to drive down a stock with honest statements?

Oh nothing they do is illegal – they’re too smart for that – but everybody knew what his angle was.

That’s basically what happened with $GME – Citron was trying to drive the price down by doing exactly that.

Two thoughts (and I don’t know nothing about all this)

1) If you’re a hedge fund who is getting bitten by this, would it be worth it to to take the collateral –which I assume is other individual stocks — and pump those up, a la GameStop, so your insane GME stock is collateralized by a different stock that you artificially pumped up? I mean, these people essentially have unlimited resources when they have a scheme in mind.

2) It feels like the solution to this is some kind of version of the GM general stock where the TARP program allowed them to zero out the old stuff and put any assets in the new shell, allowing the old GME to go to $0. If you’re the short-seller, you’re holding the stock right? So you should have a say at the shareholders meeting.

I understand that doesn’t make any of it “right” — I’m cheering for these hedge fund assholes to kill themselves — but it feels like a chance for that elusive Unity in Congress to hold off on the impeachment trial for 6 months while dealing with preserving wealth for donors/potential-donors.

Short sellers don’t own the stock. They borrowed it so they could sell it. Whoever bought the borrowed share owns it.

That is so stupid. These short sellers should go bankrupt then. If I understand correctly, they are betting on the game without actually participating.

Second to people telling me how I should run my business/finances, I hate people who try to cheat then cry when they get screwed (you’re god damn right I don’t think contractors who don’t pay into UI should be getting UI).

Short sellers are like people who bet on the “don’t pass” line at the craps table.

At least those people put chips down. These pricks are standing on the side telling the house that they’re good for it if the shooter rolls a seven.

Play or don’t play. I don’t have time to figure out what is justice for people who won’t check a box.

I don’t understand craps, at all, but I do know that short sellers are human scum, and therefore I now hate anyone who bets the “don’t pass” line at the craps table, which are a string of 7 words that have no meaning to me.

In craps, you can bet on the pass line, which is that the shooter hits the 7 or 11 on the first roll, or hits another number and then hits it again. Everybody at the table is happy when that happens, because in addition to the pass line bets everything else stays alive. Betting the “don’t pass” line is the reverse, and the odds aren’t any better than the pass line, so you are scum if you bet it.

Actually, the odds on “Don’t Pass” are very slightly better than on “Pass” but not enough to make the social opprobrium worth it

Also, you can’t do odds bets from the no pass line, and those are the absolute best bet you can make against the house

Ah yes, thanks for providing the correct information. There’s no house edge for odds bets, right? It’s a completely fair bet?

Correct!

ah am a liberal, ain’t s’posed to now how money works smh

My understanding (from educated conservatives) is this:

1) Give all money to the already wealthy

2) Make it so they don’t have to pay taxes on it

3) ??????

4) We all win.

3) is “They all urinate on us”.

How much does that cost?

-D Trump

/allegedly

They call it trickle down, but yeah, we’re getting pissed on.

If they piss enough on us, all of our boats will rise!

The trouble with trying to help a lot of people with money (or anything else) is that they are stupid.

Oh God, I remember trying to explain to the QC girls how the employee stock purchase program worked and how it was basically free money (put money in a fund, at the end of 6 months that money would be used to purchase company stock at either the first day price or last day price, whichever is lower, at a 10% discount). All they did was shake their heads at me.

I’d call them the C word.

Cthulu.

Chargers?

Let’s not get insulting

Call girls?

Because they’re only hookers when they’re dead.

Seems to me that there’s an opportunity for a large institutional investor to step in, buy out the short sellers’ position at a discount, and then wait it out. It’s one thing to put the squeeze on some hedge fund that got itself overextended, but you ain’t waiting out Berkshire Hathaway (I have no idea if they would do this sort of thing, but I know they’ve taken reinsurance bets.) Meanwhile the short sellers have perhaps taken a haircut but aren’t getting broken.

The people pumping up the stock may not be liquidity-constrained, but some of them will be tempted to cash out their profits, and others will get bored eventually.

How would a Berkshire Hathaway get their hands on shares to sell to the short-sellers? They’d have to buy them at market prices. Or if they were already holding them, why would they sell them to the short-sellers at a discount?

I suppose “buying out” the short position was the wrong phrase — I assume those contracts aren’t delegatable unless the counterparties agree.

But regardless of how it’s technically accomplished, I’m considering a scenario where they effectively bankroll the short-sellers, providing them with the liquidity to meet their interest obligations, in exchange for a piece of the (eventual) profit.

Basically — the short sellers have a position that will probably in the long run be profitable, but they’re getting squeezed in the short run. The big investor steps in to provide the liquidity to survive the short run, in exchange for a piece of that long-run profit.

Once you eliminate the liquidity problem, then it’s a game of chicken. Can the Redditors maintain enough group discipline to keep propping up the price longer than the big investor is willing to wait to reap its profits? I’m guessing not.

Kinda what happened once already on a smaller scale, and the “lender” got wiped out. So I guess the question is, why would a large investor bother? They would do better joining the Redditors.

Citadel already did that (more or less) to the tune of 2.75 billion with Melvin Capital. And it’s gone. Already. It went up in smoke before the opening bell had even rung.

Will these people be jumping off of skyscrapers in NYC or will I have to follow local papers to see how these fine people will manage suicide while working from home?

Perform a double decker, then swan dive from the top of the toilet.

Berkshire Hathaway is a “buy at a good price and hold” investment company. Warren Buffett would never do crap like this, which is just gambling.

Yeah, it was just a big name I thought of offhand. I know that they have an insurance division that does reinsurance including for earthquakes. But that’s a different kettle of fish obviously.

So, when the hedge funds get margin called or whatever it is and don’t have the money to cover the debt, is it just on paper or are they really done and will close? Or something else?

The collateral they had to put up to borrow the stock will get liquidated. Same as a bank foreclosing on your house.

Oh shit

and thanks

Nice cameo by Doug Martin; short and sweet.

There was probably an Andy Reid shortribs joke I left on the table, but he’s busy prepping for the Super Bowl.

“Short ribs left on the table? May I?” -Andy Reid

To be fair to Mr. Reid, if there are short ribs left on the table, I’m going to try to have some as well

deleted due to shitheadedness

meh, Shithead away

Looking at NOK trade volume…are they next? Or Blackberry? Or you think this is a one time thing?

Personally I think it’s a one time thing. I think it will be attempted with other stocks and will fizzle out those times.

Seems logical, yeah.

Noooooo, let’s play around in all of these short squeezes. Those wsb guys seem committed to getting revenge on the hedge funds.

pledged to hold it until the shorts decided to surrender

A regular occurrence for Coach Reid

I’m going to GameStop at lunch to buy whatever I want. And it’s close to Del Taco, so there may be other reasons this seems like a good idea to me.

I’m gonna buy the stock just before you go; once you purchase Animal Crossing 5, it’s gonna explode the stock and I’ll be rich!

I’ll buy Skyrim for every console (I’m still missing a copy for the Switch) I have at the house, and you will benefit in so many ways. Just think of the dinners with the Rothchilds and the Queen you will be required to attend.

Fuck, gonna need a new denim jacket.

As long as they stay in business until February, because I preordered Persona Strikers for Senorita Weaselo as part of her Christmas present (again because she’s obsessed) and I don’t want to have to buy it twice for her.

Pretty sure this capital infusion is going to help them make it through.

They did Express too, but that’s dropping like a rock right now.

Are you, I mean “the Losers Club” gonna hit up AMC? Sittin around 15 now.

The fine folks at r/wallstreetbets think that $AMC is a distraction, and they haven’t steered me wrong (in the last fifteen minutes, at least).

Fair enough. THIS IS FUN THOUGH.

It’s really, really fun.

Note how $GME closed at $148 last night? It’s at $345 right now.

Did I say $345 I mean $359.

Did I say $359 sorry I meant $370.